oregon 529 tax deduction 2020 deadline

State income tax deadlines are approaching but families saving for college may still have time to reduce their 2021 taxable income. The first state to make Labor Day an official holiday and to vote entirely by mail Oregon recently celebrated another first.

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

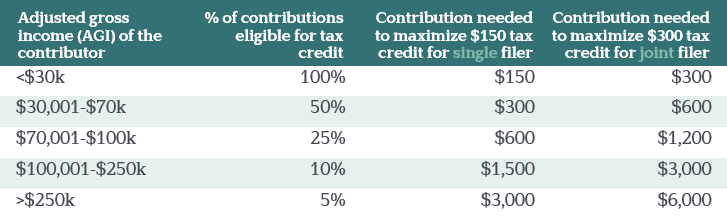

The Oregon College Savings Plan is moving to a tax credit starting January 1 2020.

. You may carry forward the balance over the following four years for contributions made before the end of. For a short window of time Oregon taxpayers can qualify for both a deduction and a credit over the next four years. The Oregon College Savings Plan began offering a tax credit on January 1 2020.

November 22 2019. Excess contributions made through the 2019 tax year remain eligible. If you file an Oregon income tax return contributions made to your account before the end of 2019 are.

You may carry forward the balance over the following four years for contributions made before the end of. Go to Oregon 529 Plan Deduction 2020 website using the links below. April is generally tax season.

Starting January 1 2020 Oregon. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Contributions and rollover contributions up to 2435 for a single return and up to 4865 for a joint return are deductible in computing Oregon taxable.

Enter your Username and Password and click on Log In. The credit replaces the current tax deduction on January 1 2020. At the end of 2019 I contributed 24325 to carry forward state tax deductions of 4865 over the next 4 years.

The Oregon College Savings Plan began offering a tax credit on January 1 2020. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an ABLE account and later made a nonqualified withdrawal. Currently over 30 states including the.

While filing and paying taxes can be painful governments offer several deductions that can reduce a familys tax burden and increase any. If there are any problems here are some. Starting in 2020 the program changed to a tax credit which maxes at 300 for.

529 Plan Advertisements And Marketing Collateral

Taxes Are Due July 15 Experts Say Save 90 Money

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Tips For Grandparents Using A 529 Plan To Save For College

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

529 Plan Tax Benefits And Advantages Learning Quest

Tax Benefits Oregon College Savings Plan

How To Use A 529 Plan For Private Elementary And High School

Browse Our Forms Oregon College Savings Plan

Oregon State Tax Software Preparation And E File On Freetaxusa

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Benefits Oregon College Savings Plan

The Irs And Treasury Are Working Overtime To Provide Taxpayers With Joy Hope And Optimism During These Trying Times Larry S Tax Law